Gold is an asset many investors choose for the long-term, often in the sense of a retirement holding, since the physical commodity, along with other precious metals, can be placed in an individual retirement account.

These are special retirement accounts referenced as self-directed IRAs or SDIRAs with gold as the holding. The account owner decides when and what to invest.

Many look for informationals provided by trusted resources like InvestingInGold.com but otherwise receive no recommendations or advice on how to use their funds.

There are, however, stringent stipulations imposed on these IRAs with IRS codes meant to protect the tax-sheltered holdings. Doing due diligence in researching the guidelines to ensure compliance with the regulations is essential.

Primarily, an investor is responsible for employing the services of a custodian versed in SDIRAs with knowledge of precious metals.

The custodian administers and manages the account from sign-on until the IRA terms. A priority is to ensure this entity is approved by the IRS and specializes in the investment of your choice. These firms help with what can be a complex investment process. Let’s review some steps to see how a gold IRA works.

Page Contents

How Does A Gold IRA Investment Work

A gold IRA is a self-directed individual retirement account backed by gold or another precious metal, either palladium, platinum, or silver. The SDIRA is driven by the account owner responsible for deciding on investment choices and when to invest.

That’s not to say there isn’t informative literature meant to offer guidance to investors. In addition, the IRS stipulates that there must be a custodian specializing in self-directed accounts administering and managing the account.

The entity can be beneficial for the investor unsure of the complexities involved with starting the gold IRA investment process. Examine these steps to learn how to proceed with an SDIRA investment backed by gold.

● The fundamentals of the account functionality

First and foremost, you must ensure that a gold IRA will benefit your specific retirement strategy. Some things to take into consideration before committing:

- Type: In the same vein as a conventional IRA, you can choose either a Roth or Traditional account. When selecting the Traditional option, taxes would be paid after funds are withdrawn, but Roth allows payment before any money is taken.

- Fees: More fees are associated with an SDIRA than a conventional IRA. Investors will likely see a set-up charge, management fees, storage costs, and much more when signing on. The suggestion is there might be savings based on the type of account you select.

- Contributions: Contributions work precisely as they do with a conventional IRA with $1000 more allowable contribution funds for those over the age of 50.

● The precious metals firm needs to be selected

A priority is to select a precious metal firm to open your account and handle transactions. Usually, this company will serve as the custodian on the account and must specialize in self-directed IRAs, plus be versed in gold as the holding. That means they need to have approval from the IRS. Some things you want to ensure:

- Trusted: The number of years the entity has in the industry will speak to its reputation and expertise in efficiently managing retirement accounts. There are many scammers in this industry, making it crucial for you to do due diligence when searching and ensure your comfortability with the final prospect.

- Policies/Fees: Determine the fees for the varied firms you consult to find the best prospect. Standard fees for a gold IRA often carry either a flat rate or work on scaled fees. When offering a flat rate, your rate could be fixed for the IRA. If there is only a scaled option, you could ultimately pay much more depending on your negotiations with the firm.

● There are a few ways you can make contributions

You can start investing in your gold IRA once you find the custodian with whom you decide to open your SDIRA. Contributions can be made in a few ways:

- Cash: Commonly, investors will choose to use cash contributions, whether opting to do a wire transfer, use a check, or use money; there are numerous funding choices under this category.

- Transfer: If you have an existing retirement account, those funds can be transferred to the new gold IRA. The custodian from the current account will send the funds to the new custodian without receiving any funding for the transaction.

- Rollover: Part of a retirement account goes into the gold IRA without using any additional funds. The existing custodian will issue you the necessary funding. Still, you will have only 60 days to contribute these funds to the gold IRA before there are tax implications and the potential for penalties.

● Buying and storing precious metals with your custodial service

The custodial service might allow you to buy your precious metals from them directly or expect you to work with a precious metals dealer to obtain them. In either scenario, the representative will assist in ensuring you remain in compliance with the IRS guidelines.

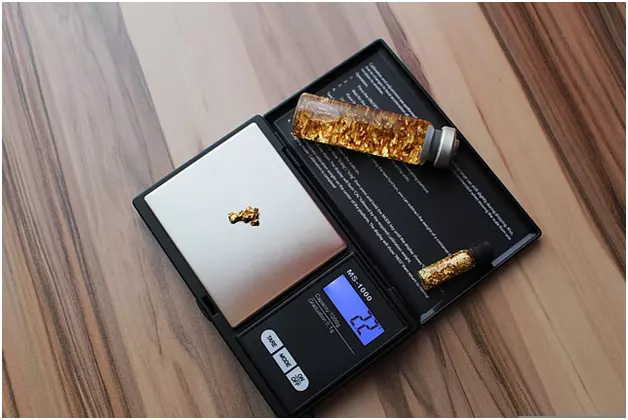

There are specific standards applied to the metals per the IRS based on type, i.e., coins, bars, bullion, and quality, i.e., fineness.

Once you purchase your products, the gold will be shipped to an IRS-approved, insured storage depository, where it will remain until retirement or age 59.5. That isn’t to say that you cannot sell your gold before that point, but the funds you receive for the transaction must remain with the IRA until retirement.

If you attempt to make any withdrawals, there will be tax implications and penalties, or if you try to store your gold at home, you will be subject to these tax implications and penalties in the same vein. Go here for details on investing in a gold IRA.

Final Thought

Gold is becoming a favored asset among investors, especially those looking for the ideal retirement strategy. The complexity of a gold IRA can be intimidating to some. Still, the draw of the financial stability trumps that.