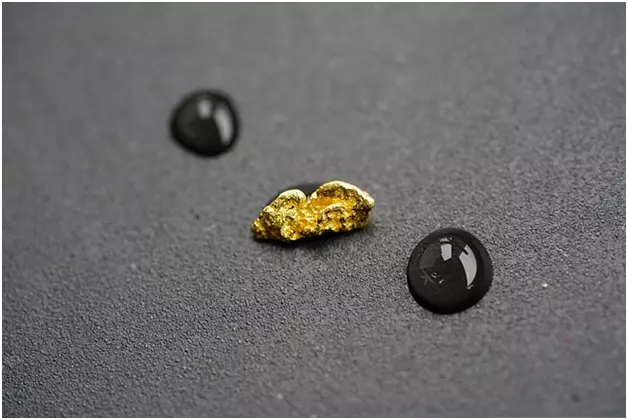

In commodities trade, raw materials are bought and sold instead of manufactured goods, completed structures, or monetary assets (like bonds and stocks). Corn, lumber, coffee, and ore are all examples of commodities. Silver and gold investments are a popular form of commodities trading. Silver and gold are two very distinct commodities from a financial standpoint.

Consult a financial professional for more guidance before investing in gold or silver.

Gold vs. Silver in Terms of Utility

Investing in precious metals is distinct from investing in other commodities mostly due to their practicality. Investors determine the worth of most other commodities by considering supply as well as consumer demand. Coffee bean costs, for instance, can be estimated by observing trends in coffee consumption, consumer preferences, and related factors.

Because of their limited practicality in the marketplace, precious metals are unique. Gold and silver are valuable assets, but they are not widely used in consumer or industrial applications.Nonetheless, silver is used in a wider variety of commercial and industrial contexts than gold. About half of all silver that is sold goes toward industrial uses, which include anything from dentistry to technology.

Nevertheless, this is a negligible amount compared to the vast majority of metals that are put to industrial use. In contrast, the only real market for gold is in the jewelry industry.

Investors can make educated decisions based on variables like industry demand and the state of the world economy, which in turn can be used to predict future silver price changes. The best thing to do is to check out this link httpsssss://www.kingoldjewelry.com/gold-alliance-capital-reviews/ to discover more about the right type of investment to go for.

Gold vs. Silver in Terms of Cost and Volatility

Silver was worth about $25.77 per ounce as of this writing. The price per ounce of gold was around $1,960. Inconsistent gap size: specifics may change. Through the ages, gold has consistently commanded a premium over silver. One reason for this is that silver resources are roughly twenty times more prevalent than gold deposits. There are two possible outcomes for investors as a result of this.

To begin, silver is a more accessible investment option than gold. Silver’s lower price per ounce makes it more accessible to investors with fewer liquid assets. Silver, like any other financial asset, can increase your vulnerability to both gains and losses because price fluctuations are more likely to be extreme in relation to the size of your portfolio.

In contrast, that is also the standard definition of volatility. Due to the disproportionate impact of even slight price shifts, low-cost assets are notoriously volatile. Taking the present price of silver, as an illustration, a 10% change in price would only require a change of $2.57 per ounce. A $2.57 shift in the gold price would amount to a 0.0013% swing.

Keep an eye out for instability if you’re looking to invest for the long haul; it’s not always a bad thing, but it’s something to be aware of. You can click here to find out more.

Comparison of Gold and Silver in Light of the Market

Gold’s price usually follows a pattern opposite that of the stock market. Gold is an example of an “anti-cyclical asset.” Therefore, it typically appreciates when more widely held assets decline and vice versa. As the stock market declines, investors have a tendency to shift their assets towards safer havens, such as gold.

During prosperous periods, gold holdings are typically reduced and the funds reallocated to other assets with stronger ties to the economy as a whole.

Many people keep gold in their portfolios for this same reason: to use it as a quick source of cash in a crisis. When the economy is down, for instance, it’s not the ideal moment to sell shares but the ideal time to purchase them. Getting a gold investment in place before a recession hits can provide you with a liquid asset to sell, allowing you to buy other people’s cheap assets without having to liquidate your own.

In contrast to gold’s independence from economic factors, silver is more closely tied to it. One major reason for this is the widespread usage of silver in industry, which also makes it a more stable investment. The price of silver falls as the manufacturing sector uses less of it amid a recession.

Where Should You Invest Your Money?

A “superior” investment does not exist in a strict sense. The market and your portfolio will determine your options. As a general rule, silver is an excellent investment for the future. This is a speculative asset that is moderately likely to increase in value. If you want to hedge your bets against an economic downturn, gold is the way to go.

If you want to secure liquidity in the case of a recession, this can be a decent countercyclical asset, however, in the long run, a decent S&P 500 index fund would do you better.

What It Comes Down To

Because of their long association with currency, precious metals like silver and gold are often seen as safe haven investments. At one time, governments minted their money out of precious metals. Gold and silver are still considered by many as viable assets by investors despite the fact that no major economy utilizes them as currency.

Silver is less stable than gold, more affordable, and intrinsically related to the manufacturing sector. Gold is costlier but offers greater portfolio diversification. Either one or both could be useful additions to your investment portfolio.

Advice for Purchasing Precious Metals

The most important thing you can do is research your options. Gold’s best utility as an asset is probably in reducing overall portfolio risk. When the market is down, this asset might provide you with value even if your other investments are falling in value.

If you need help deciding whether gold would be more beneficial to your portfolio, consult a financial professional. It is not necessarily difficult to locate a competent financial counselor.